New York State inflation tax rebate checks mailed out, 8.2 million households can receive up to $400

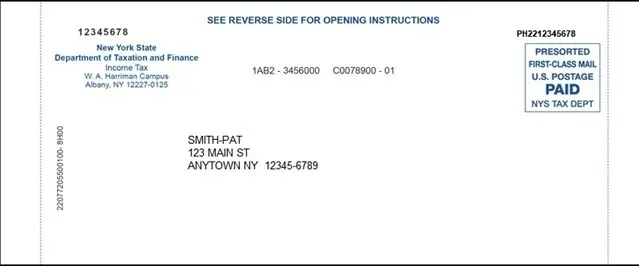

The New York State government promised in May to mail out inflation refund checks to eligible New Yorkers this fall. The checks will be sent automatically to eligible residents, without the need to apply. It is expected that 8.2 million households will receive refunds of up to $400.

![]()

The New York State government promised in May to mail out inflation refund checks to eligible New Yorkers this fall. The checks will be sent automatically to eligible residents, without the need to apply. It is expected that 8.2 million households will receive refunds of up to $400.

Governor Kathy Hochul announced at a press conference on the 26th that the program has begun, with checks being mailed to residents. She believes the refunds will help alleviate the pressure on families facing rising prices. She also stated that during the past few years of rising prices, the state collected billions of dollars more in taxes than budgeted, leading to the decision to return the money to taxpayers. “You work hard, but the bills keep piling up, and New York families are sometimes feeling the pinch.”

The Governor’s Office emphasized that residents do not need to take any action; they just need to wait for the checks to arrive. Furthermore, the checks will not be sent sequentially by ZIP code, so residents in the same neighborhood may receive their checks at different times.

To receive a refund check for the 2023 tax year, residents must meet several requirements, including having filed New York State Resident Income Tax Return Form IT-201, having income within specified thresholds, and not being a dependent on another taxpayer’s return. In other words, residents who did not file a tax return in 2023 will not receive this inflation-adjusted refund.

Eligible taxpayers will receive specific amounts based on their income: $400 for joint filers with an annual household income of up to $150,000; $300 for joint filers with an income between $150,000 and $300,000; $200 for single filers with an income of up to $75,000; and $150,000 for single filers with an income between $75,000 and $150,000.

Based on the regional distribution of inflation-adjusted tax refund checks, 3.53 million people will receive them in New York City, 1.25 million in Long Island, over 920,000 in the mid-Hudson River region, 585,000 in Western New York, 513,000 in the Finger Lakes, 475,000 in the Capital Region, 321,000 in Central New York, 251,000 in the Southern Tier, 198,000 in the Mohawk Valley, and 156,000 in the North Country.

The State Department of Revenue stated that with over 8 million New Yorkers receiving refunds, it will take several weeks for all of these checks to be mailed out. Because mailing is not based on ZIP codes or regions, some residents may receive their checks earlier or later than their neighbors. The State Department of Revenue could not provide a specific delivery schedule, and its contact center representatives were unable to provide further information on the status of residents’ checks.

![]()