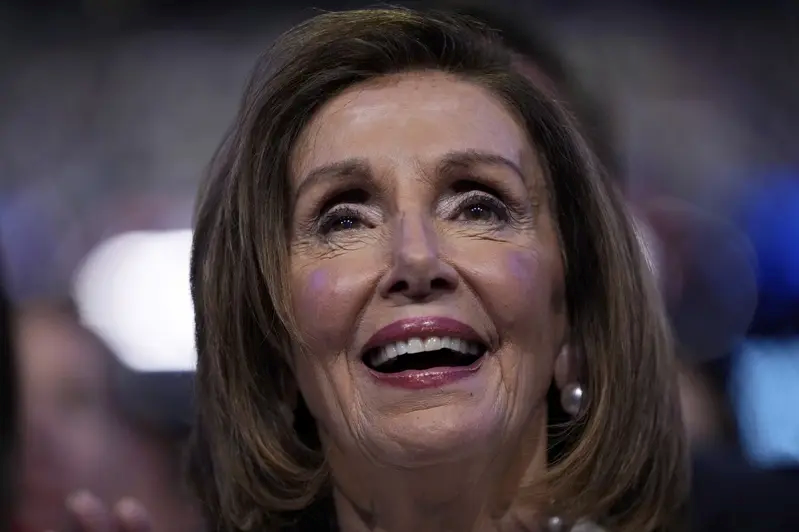

With a return rate of 54%, Pelosi’s actions are worthy of being called the “Wolf of Wall Street”

The New York Post reported on the 21st that California Democratic Congresswoman Nancy Pelosi’s investment gains surpassed all large hedge funds in Bloomberg’s year-end statistics, and she can be called the “wolf girl” of Wall Street.

According to the latest public financial declaration information, Pelosi earned about $7.8 million to $42.5 million in 2024, and her and her husband Paul Pelosi, who is engaged in venture capital, may have a combined net worth of up to $413 million.

And this astonishing figure has increased significantly compared to the data reported in 2023, when the upper limit of their assets was about $370 million.

Because members of Congress only need to declare the asset range, the actual net worth of the Pelosi couple is unknown. However, according to Quiver Quantitative, a market research company that tracks daily stock changes, the two are estimated to have a net worth of about $257 million in 2024, an increase of about $26 million from the previous year.

In addition to stock assets, Pelosi also holds other corporate investments, including a winery in Napa Valley, a political information and consulting company, and an Italian restaurant in the San Francisco Bay Area, which may make their actual assets much higher than the above valuation.

The wealth of the two mainly comes from a large number of stock investments and precise operations. Pelosi is famous for frequent transactions and keen stock selection. Republican Senator Josh Hawley of Missouri even proposed a no-trading bill named after Pelosi.

All transactions are conducted in the name of Pelosi’s husband Paul.

For example, in July 2024, the Pelosi couple sold 5,000 shares of Microsoft stock, with a market value of approximately US$2.2 million, which was the largest sale transaction in three years; a few months later, the Federal Trade Commission (FTC) launched an antitrust investigation into Microsoft.

They also sold 2,000 shares of holdings, valued at approximately US$525,000, three months before Visa was sued by the Department of Justice for antitrust.

The most eye-catching transaction may be that in December 2023, the Pelosi couple bought 50,000 NVIDIA call options for about $1.8 million, with an exercise price of $12 per share, which is only one-tenth of the market price; this $2.4 million investment is now worth more than $7.2 million.

In addition, they spent $600,000 to $1.25 million to buy call options for California security company Palo Alto Networks in February last year. In the same week, the White House briefed Congress on a major national security threat related to Russia. The stock rose nearly 20% a few days later. The investment is now worth about $2.8 million.

The call option allows them to buy 14,000 shares of Palo Alto stock at $100 per share (only half of the market price).

However, this “female stock god” occasionally fails. In June 2024, the Pelosi couple sold 2,500 Tesla shares, with an estimated loss of between $100,000 and $1 million.

Overall, the Pelosi couple’s portfolio gained about 54% in 2024, far higher than the 25% annual increase in the S&P 500 Index, and also outperformed all major hedge funds in the annual compensation list compiled by Bloomberg.

This huge profit has once again triggered calls to ban members of Congress from trading individual stocks. Critics point out that members of Congress may have key market information in advance.

Pelosi has opposed the ban in the past, saying “we are a free market economy”; but as the criticism grew, her position softened. When asked in May last year whether she supported the ban, she responded: “If they want to pass it, then pass it.”

In response to related questions, Pelosi’s spokesman told the New York Post: “Speaker Pelosi herself does not hold any stocks and has no prior knowledge or subsequent participation in any transactions.”

Entering 2025, the two are still active. In January this year, they bought a call option for Tempus AI, a little-known artificial intelligence health company at the time. The company later signed a $200 million contract with AstraZeneca, and its stock price doubled.

They also bought call options on energy company Vistra, which surged last month after announcing it would buy several natural gas facilities for $1.9 billion.